“The bank is dead.” “No one goes into a branch anymore.”

When I talk about bank design, I hear statements like this often. After more than a decade of designing financial retail spaces, I can confidently say the branch isn’t dead. It’s simply evolving. Yes, digital banking is convenient and growing fast. Physical branches still play a vital role, especially as financial institutions search for new ways to build trust, offer guidance, and support their communities.

What’s changing isn’t the need for branches—it’s what they’re needed for. There’s a growing gap between transactional convenience and meaningful financial support, which presents a powerful opportunity.

A GROWING DEMAND FOR FINANCIAL WELLNESS

Recently, my team conducted a research study exploring how people across generations engage with financial institutions today. We analyzed four different organizations—from regional credit unions to large national banks—and included an online-only provider to round out the comparison.

One of the most striking insights from our research was the deep-rooted lack of trust—particularly among millennials—toward financial institutions. As a millennial myself, I hadn’t fully recognized this skepticism until we started unpacking specific scenarios in our interviews. It became clear that this generation tends to be less influenced by traditional advertising and more likely to place trust in firsthand experiences or word-of-mouth recommendations. They’re not looking for polished campaigns; they’re looking for authenticity, transparency, and consistent human interaction to feel confident in a brand’s promise. This finding underscores the growing importance of building real relationships—not just delivering services—especially as expectations around financial wellness continue to evolve.

Ultimately, our goal was to better understand how financial services are sought out and used in today’s rapidly changing landscape. Despite the variety in size, structure, and delivery models, one clear theme emerged across all generations and institutions: a growing demand for financial wellness.

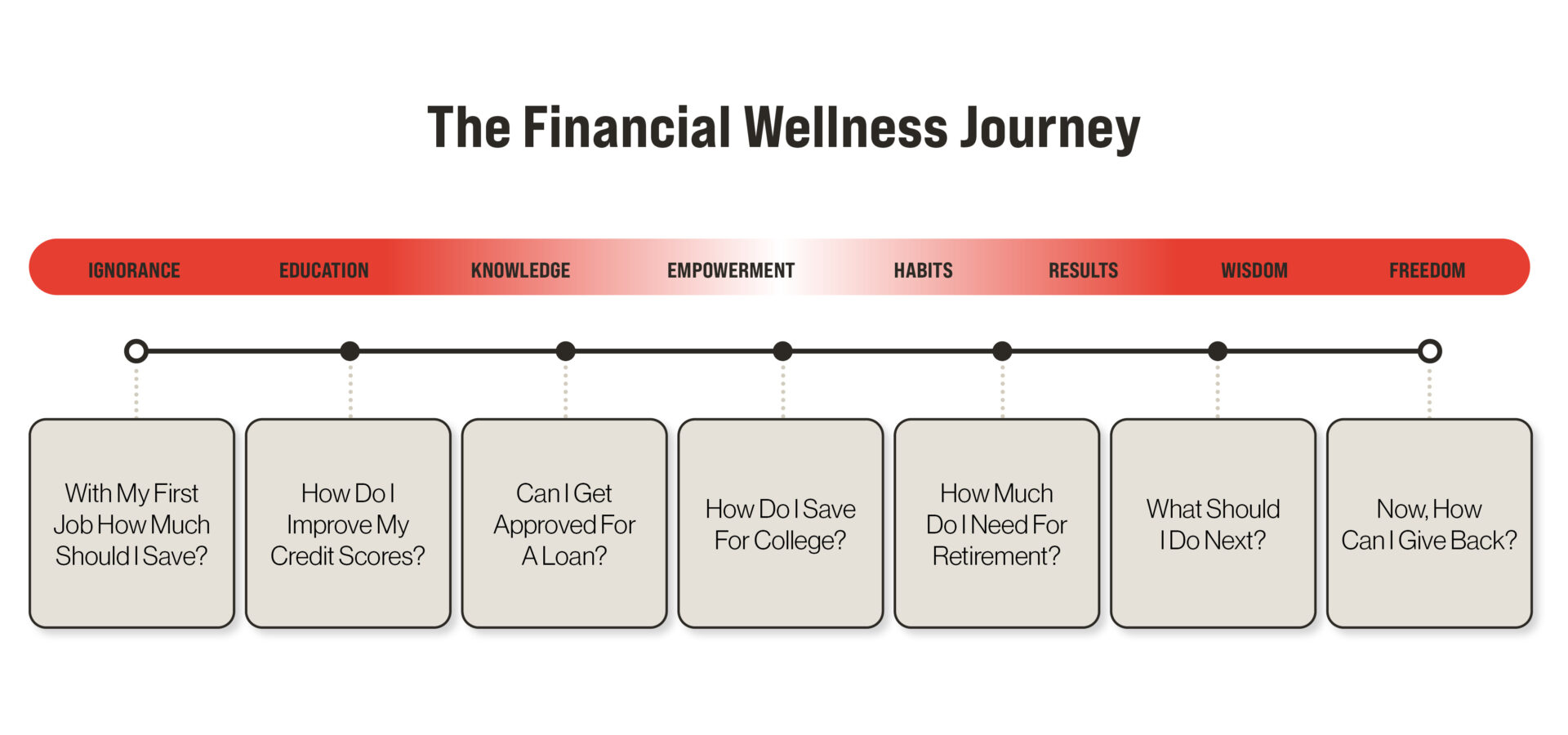

So, what does financial wellness really mean? According to the Consumer Financial Protection Bureau (CFPB), financial well-being is defined as having financial security and financial freedom of choice, in the present and in the future. Essentially, financial well-being goes beyond budgeting apps and savings accounts. Financial wellness is about a person’s overall sense of stability, confidence, and control over their financial life today and in the future. And for many, money is deeply emotional—tied to security, opportunity, and personal identity. Banks have long operated at the center of these personal and business decisions, making every customer interaction more than just a transaction. Whether the experience is positive or negative, it’s shaped by how well a financial institution helps someone understand their situation and take meaningful steps forward. At its core, financial wellness is about helping people feel informed, empowered, and supported as they navigate every stage of life—from their first paycheck to retirement and everything in between.

While most banks still provide familiar services—secure transactions, safekeeping, even complimentary coffee—those offerings are no longer differentiators. People can transfer money from their phones, store valuables digitally or at home, and grab coffee anywhere. What financial institutions uniquely offer today is guidance: the human expertise and support needed to help individuals navigate their financial lives.

THE UNTAPPED POTENTIAL OF EARLY ENGAGEMENT

Here’s the challenge: by the time most people begin focusing on financial wellness, they’re already playing catch-up. The language of finance can feel intimidating, and their ability to course-correct is often limited.

But what if financial institutions engaged people sooner—before they even open their first account?

Picture this: A high school student takes a personal finance class co-taught by educators and local bank representatives. They learn how to budget, build credit, and avoid common financial pitfalls. By the end of the semester, they open a savings account at the neighborhood branch they’ve come to know. Maybe they even apply for a part-time teller job or a summer internship.

That student isn’t just financially literate—they’re financially confident. And their relationship with that institution is no longer transactional; it’s personal, long-term, and built on trust. That connection can carry them through life’s many milestones—seeking guidance on student loans, financing their first car, buying a home, starting a business, saving for college, investing wisely, or planning for retirement. By establishing that relationship early, financial institutions can become a lifelong partner, offering support and expertise at every step of the journey.

And yet, there’s an even earlier opportunity that many traditional banks are overlooking. Online-only platforms like Greenlight are already targeting kids as young as six—offering savings and checking accounts designed to teach financial responsibility through real-life experience, like managing birthday money or earning an allowance. It’s a smart move, and it highlights a growing gap in the market. While these digital-first institutions have recognized the potential in engaging children early, most brick-and-mortar banks have not followed suit. According to an Accenture survey of 49,000 banking customers worldwide, about two-thirds of U.S. consumers—across all generations and regions—still value having a physical branch in their neighborhood. Chances are, many parents would prefer to walk into their local bank to open an account for their child, but the option simply doesn’t exist. This is a moment of opportunity: to bring early financial education into the community, through the trusted, tangible presence of the local branch.

DESIGNING FOR FINANCIAL EDUCATION: AN ARCHITECTURAL PERSPECTIVE

So how can a branch be designed to support financial wellness? As customer expectations evolve, so must the design of bank branches. For more than a decade, I’ve been renovating existing branch locations—and one of the most common challenges we face is rethinking oversized lobbies that once served as transactional hubs. Today, those large, underutilized areas offer a unique opportunity: to be reimagined as environments for connection, education, and empowerment.

Flexible, multipurpose spaces can welcome customers while also serving as venues for financial literacy workshops, one-on-one coaching sessions, or community events. Some banks are already exploring these ideas—incorporating small libraries curated with financial resources, or lounge-style areas that host monthly conversations on topics like budgeting, credit building, and retirement planning.

But while evolving the experience, we can’t lose sight of the purpose. Financial services should remain visible and celebrated—not tucked away in the back or hidden behind a stairwell. The branch should proudly reflect its core role as a community partner—one that supports financial well-being with both physical presence and personalized guidance.

In some cases, the most powerful design decisions extend beyond the walls of the branch. Collaborating with local schools to establish in-school micro-branches or branded financial education hubs allows banks to meet future customers earlier—both physically and developmentally—making financial literacy more accessible, familiar, and relevant.

By designing with intention, branches can transform from places where transactions happen to places where understanding starts and transformation begins.

A WIN/WIN SCENARIO

Investing in early financial education isn’t just a feel-good initiative—it’s a strategic opportunity that benefits both financial institutions and the communities they serve. When banks take the lead in equipping young people with financial knowledge and resources, everyone wins.

For financial institutions, the benefits are clear:

- Create lasting relationships with younger people that extend into adulthood—building trust before the competition even enters the picture.

- Strengthen ties with the local community by showing up in meaningful ways, not just as a service provider but as an invested partner in people’s lives.

- Develop a pipeline of future employees by training students early and giving them opportunities to gain real-world experience inside a branch.

- Expand your reach to younger audiences who might not yet be on your radar but are already forming habits and loyalties.

- Foster financially educated communities who move more confidently—and quickly—along the path to financial wellness.

- Simplify future financial conversations by building foundational knowledge that makes it easier to discuss more complex services down the line.

- Build long-term trust, not through marketing, but through action and presence in the lives of the next generation.

For students and the public, the impact is equally meaningful:

- Gain early exposure to financial concepts and language, giving them a head start many adults wish they’d had.

- Understand what financial security actually looks like—and how to take tangible steps toward it.

- Begin their financial journey with confidence, before habits are formed or missteps are made.

- Learn how to give back to their communities, thanks to the stability that comes with financial wellness.

- Develop workforce readiness skills that go beyond finances—like professionalism, communication, and customer service.

- Form a relationship with a financial institution that can support them through every life stage, from student checking to first mortgage and beyond.

- Build trust in a system that often feels intimidating or inaccessible—because they’ve seen firsthand what partnership can look like.

When banks lean into this model, they don’t just build customers—they build communities that are more informed, more empowered, and more loyal. That’s the kind of impact that lasts.

REIMAGINING THE ROLE OF THE BRANCH

Banks have long recognized the value of meeting customers early in their financial journey—just think of the decades-old presence of branches and pop-ups on college campuses aimed at capturing the attention of 18-year-olds opening their first accounts.

But times have changed. Today, younger people are managing money earlier, navigating digital tools, and facing complex financial decisions long before college. What they need isn’t just access to products—they need guidance, education, and a trusted resource to help them build financial confidence from the start.

By shifting focus to earlier engagement—whether that’s middle school, high school, or a customer’s first job—financial institutions can play a meaningful role in shaping lifelong financial wellness and helping to close the knowledge gap we currently find ourselves in. The opportunity is there: design spaces and experiences that support not just transactions, but real connection and growth.